Are you an online business owner feeling overwhelmed by all of the financial aspects that your business involves? A bookkeeping system that monitors and accurately records all payments, sales, expenses, and taxes is essential in order for online stores’ success. For accounting reports and tax returns, filing them at the end each year and keeping track of cash flow, bookkeeping is an extremely useful tool.

Running a successful ecommerce business is more than good products and marketing strategies. To ensure that the business is profitable and compliance financial management plays an important role behind the background. In this article, we will examine the most important elements of financial management for ecommerce such as bookskeeping, tax preparation and accounting. Knowing and understanding the fundamentals of e-commerce is essential for longevity and long-term success.

Bookkeeping is the core of good financial management for companies that operate online. It involves keeping track of and arranging financial transactions such as expenses, sales and inventory. Ecommerce entrepreneurs can gain valuable insight into the financial health of their companies by keeping accurate and current data. Bookkeeping allows them to monitor cash flow, track the expenses and sales, and make informed decisions by analyzing real-time data. For more information, click bookkeeping

Effective bookkeeping practices are important for businesses that sell online of any size. Here are some key ways to streamline the bookkeeping process

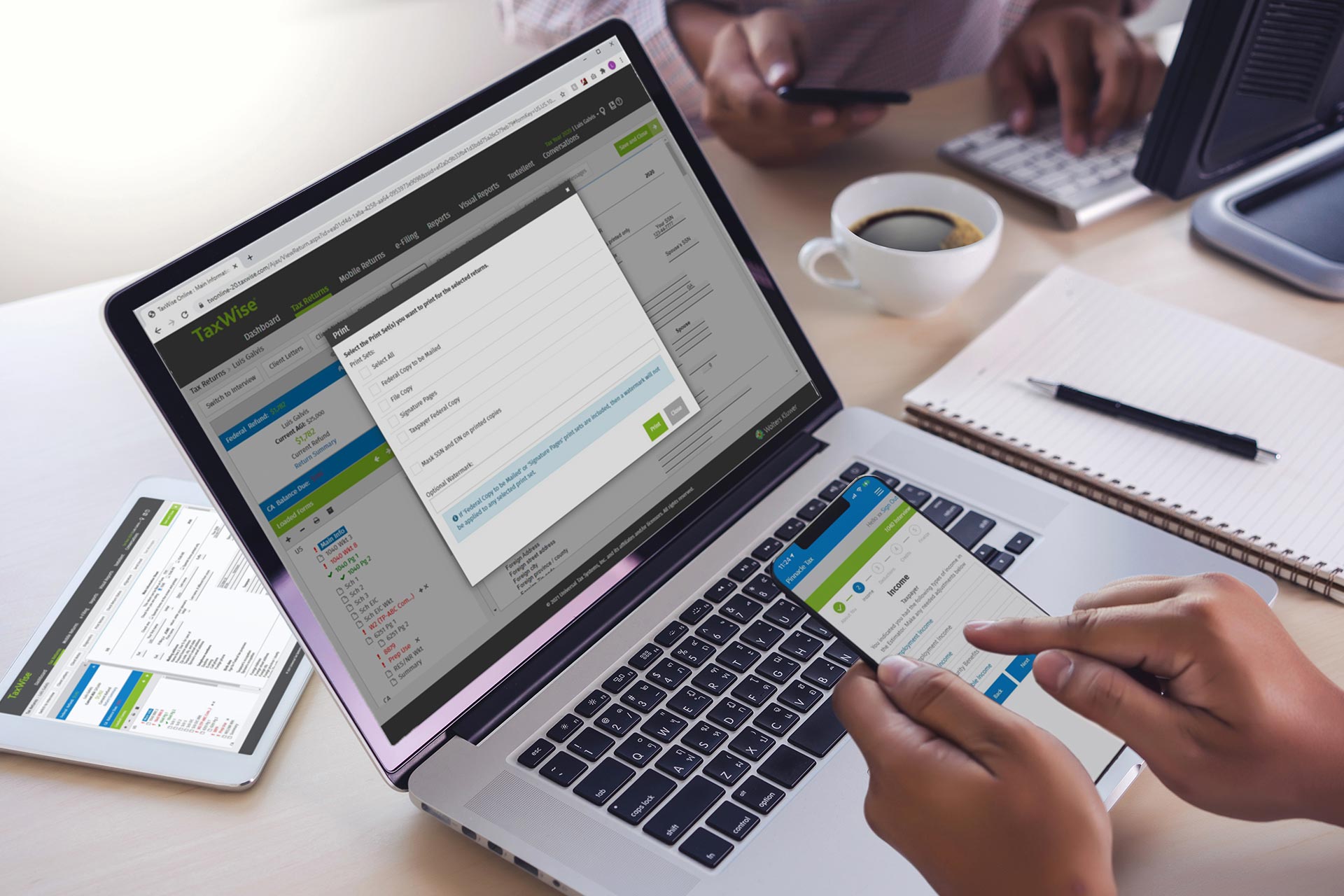

Accounting Software Make use of accounting software developed specifically for ecommerce. These tools streamline the process of data entry, generate reports, as well as offer integrations with e-commerce platforms, payment gateways, and various other platforms.

Separate business and personal financial accounts: Separating your personal and business credit cards and bank accounts to run your business online is crucial. This makes it easier to manage your bookkeeping process, simplifies tax filing, and helps ensure the accuracy of your reportage.

Sort your transactions into categories The ability to have a complete understanding of your income and expense streams is simpler when you organize them in a systematic way. Develop specific categories for sales, shipping expenses, advertising costs as well as any other pertinent expense types.

Tax preparation plays an important function in the management of finances of e-commerce. Tax regulations must be adhered to by online businesses. They have to take care of and pay sales tax where necessary and submit accurate tax returns. Consider these factors for effective tax planning:

Sales Tax Compliance – Know the requirements for sales taxes in the jurisdictions that you offer your product. Determine whether you have the nexus (a substantial presence) in those states, and whether you are required to pay sales tax and then remit it.

Keep accurate record of your transactions. Make sure you keep detailed records of all your transactions, such as taxes, sales, and other expenses. This includes documents for any exemptions or deductions that you might be entitled to.

Consult an Ecommerce Tax Expert: Ecommerce taxation is complex. Think about consulting a tax professional who specializes in ecommerce businesses to ensure that you are compliant and accurate tax preparation.

Accounting is more than just bookkeeping and tax preparation. Accounting is about analysing financial information, creating financial statements and giving a complete view of the business’s financial performance. company. Accounting is essential for a number of reasons.

Financial Analysis: Accounting lets you to analyze your company’s profitability, identify trends and make informed choices regarding growth.

Budgeting and forecasting: Accounting can help you make budgets, define financial goals, and plan future performance. This lets you organize your resources and make strategic decisions.

Financial Reporting: Through the production of financial statements, like balance sheets, income statements as well as cash flow statements, you can communicate the financial status of your company to investors and lenders.

When your business’s online presence expands and your financial needs grow, the task of managing them can become too much. In outsourcing accounting or bookkeeping services offers several benefits.

Expertise & Accuracy Expertise & Accuracy: Professional bookkeepers and accountants are experts in ecommerce finance. They are able to provide accurate accounting and financial reports.

Time and money savings If you outsource your finance services, you are able to focus on the core operations of your company while experts handle these. This could be a more cost-effective option than hiring employees in-house.

Your ecommerce site’s profitability is enhanced when you have a reliable bookkeeping program in place. Despite the fact that it can be daunting initially, and time consuming to keep track of all the data essential, having a dependable bookkeeping system in place allows you to monitor your expenditure and gain insight into areas where you can increase efficiencies and boost sales. A professional accounting firm can help you set up an effective bookkeeping system to run your business. This will ensure that the business is properly positioned to be successful. Speak to a professional like this when you’re overwhelmed or do not have the funds. You may be opening many new opportunities for your business and your company, both in the short as well as in the long-term. Why wait? Use these resources to increase your company’s profits.