Today, managing wealth is not just about protecting your assets, but about leaving a lasting legacy. Families from all over the world are seeking more than just financial advice. They’re looking for structure, flexibility, and a partner who is aware of the complexities of their lives. Dubai’s DIFC is now a destination where people are able to find the answers they seek.

Dubai International Financial Centre has attracted international families, entrepreneurs as well as entrepreneurs to its unique regulatory framework. And at the heart of it all are four tools that can be used to make a difference: the DIFC Foundation, Dubai Family Office, DIFC Prescribed Company, and Private Trust Companies.

Let’s unpack why these solutions are more than simply financial structures. They’re part of a larger story.

The DIFC Foundation – Planning with A Purpose

It’s comforting knowing that your wishes will be honored even after you pass away. DIFC Foundation DIFC Foundation is a modern structure that lets families create, safeguard and transfer wealth exactly according to their wishes.

In contrast to trusts that are traditional, DIFC Foundations offer a high level of control and customization. The DIFC Foundation is a blueprint which you can use to protect your assets and transfer shares of the business of your family, help charitable causes, or safeguard them from the unpredictability of risks.

The best part? It is a silent worker that offers security and protection from the law as well as privacy and peace of mind for generations to come.

The Dubai Family Office: Built Around People, Not Just Portfolios

Every family is unique. Some families run businesses across generations. Others manage international assets or prepare the next generation of leaders. That’s why the modern Dubai Family Office is less about a one-size-fits all solution and more about individualized.

In Dubai and the DIFC particularly Family offices have evolved into platforms that provide more than just investment management. Family offices are the center of all the important aspects for your family’s long-term goals such as tax planning and governance.

It’s not only about managing money. It’s also about managing relationships, meaning and responsibility.

DIFC The companies that have been prescribed are quiet and powerful

The wealth structure does not need to be complex or loud. Sometimes simplicity is key. This is why you should consider the DIFC Prescribed Company, a flexible and efficient tool for structuring deals and creating special purpose vehicles.

These organizations can be extremely beneficial to investors, entrepreneurs and families that want to profit from the DIFC eco-system without worrying about the burdensome regulations. Imagine them as silent engines that drive worldwide transactions while providing security, convenience, and compliance to global standards.

When used alongside foundations and trusts, prescribed companies can enhance the wealth of a family easily and efficiently.

Private Trust Companies – Trust however, with Control

Families with sensitive issues or complex needs could struggle to transfer the control of their affairs to an uninvolved trustee. Private Trust Companies (PTCs) offer a compelling alternative.

PTCs allow families to create their own corporate trustees. This allows the trustees to place important decisions into the hands of trustworthy individuals. They are typically close family members or advisors. This kind of structure is loved by entrepreneurial families and those who hold multiple jurisdictions that are seeking greater involvement, but without sacrificing strictness in the legal and fiduciary realms.

If the PTC is incorporated within the DIFC legal framework, it becomes an effective tool for compliance and oversight.

People first The human component of wealth management

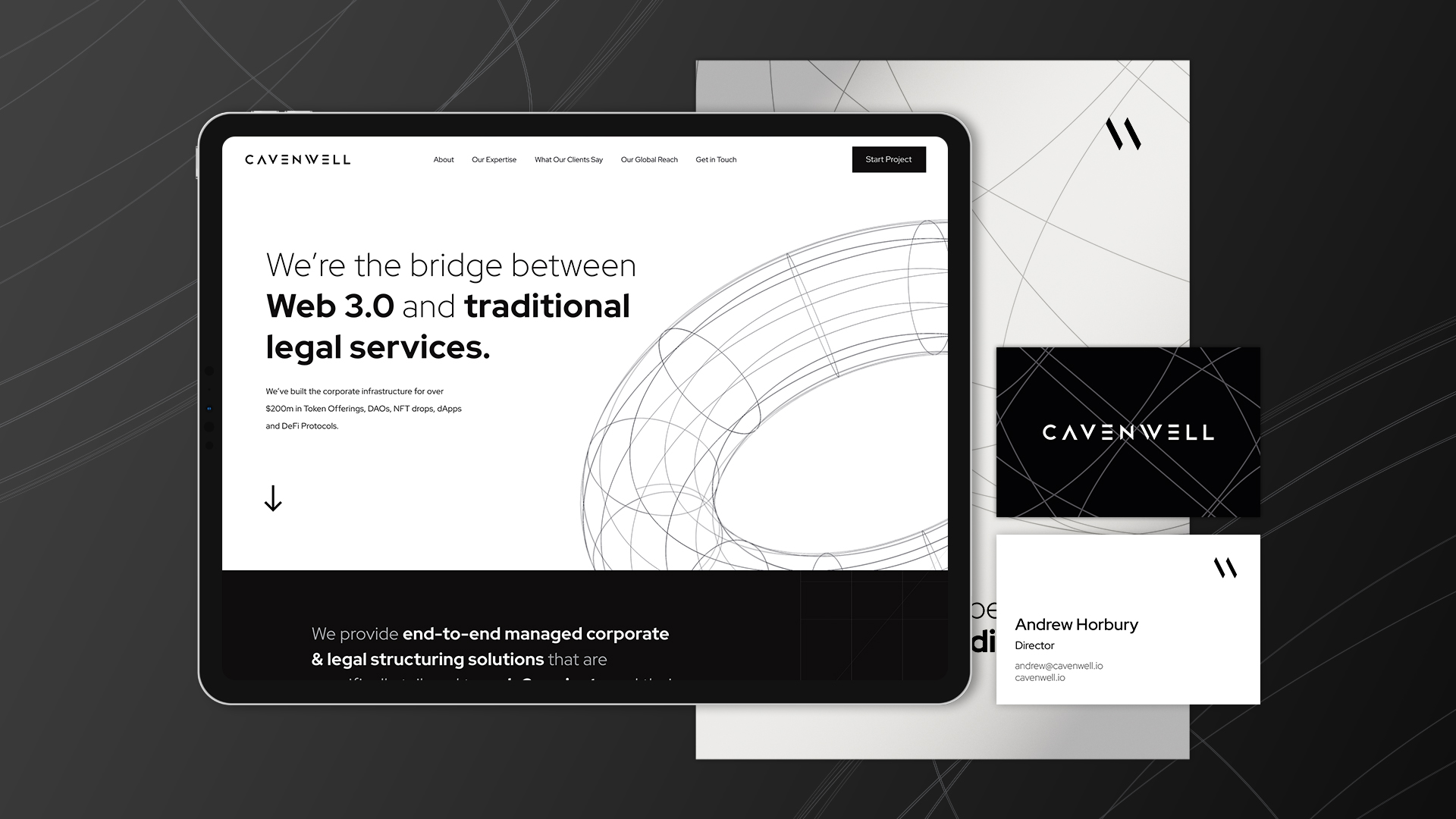

In an age of automation and digital tools it is refreshing to discover companies that are still led by empathy and personal touch. The companies Cavenwell integrate technology with human understanding to create wealth solutions that are customized and genuinely connected to clients’ needs.

In the end everything, wealth isn’t just about numbers or shapes. It’s about people. It’s about ensuring that the values you believe in reflect in the structures you build. It doesn’t matter if you make use of a DIFC Foundation or a Dubai Family Office. It’s the same with it could be a DIFC Prescribed Company.