Understanding the complex dynamics of external conditions is essential to making well-informed decisions and making strategic plans in the current business environment. PESTEL Analysis is unique from the myriad of analytical tools that can be used to evaluate these environments for its comprehensive strategy, strategic relevance and widespread use. This article will explore the PESTEL Analysis and its effect on qualitative analysis, strategic decision-making, and quantitative analysis.

PESTEL Analysis – Definition

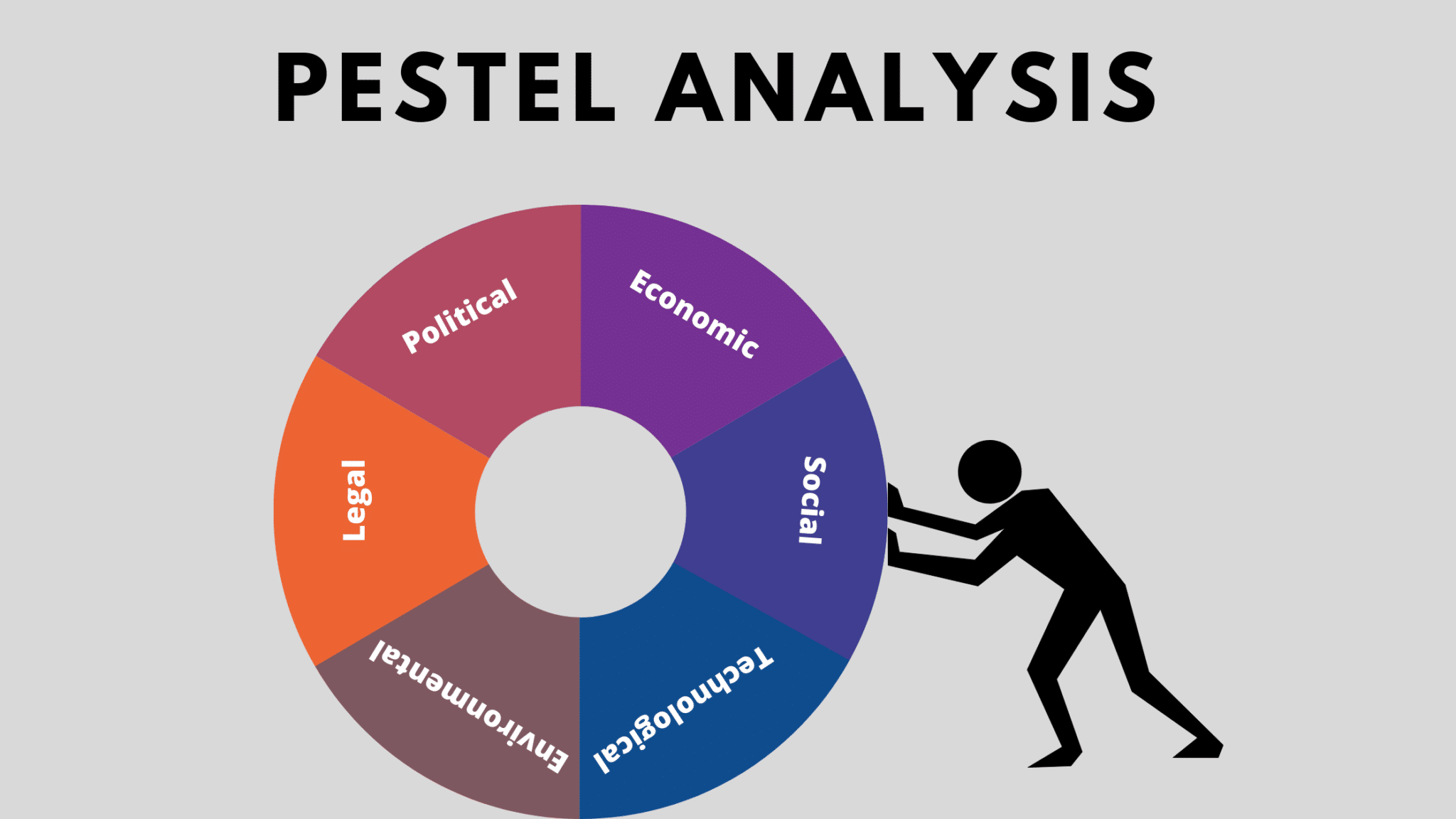

PESTEL Analysis, at its essence, is a quantitative method that examines systematically the external influences that impact the company’s performance and operation. The term “PESTEL” stands for Political Economic, Social, Technological, Environmental and Legal factors. These six categories cover an array of external factors that may influence the business environment.

Understanding PESTEL Analysis

The main goal of PESTEL Analysis is to provide businesses with a comprehensive comprehension of the macro-environment the context in which they work. Businesses can discover opportunities for growth and innovation while minimizing risks and threats by looking at the variables that are relevant to the various categories. From the changes in policies of government and economic trends to shifts in norms of society and technological advancements PESTEL Analysis offers a comprehensive method for evaluating the external context.

Qualitative Analysis: Its Role

In contrast to traditional financial analysis that focuses on quantifiable metrics like revenue and profit margins, PESTEL Analysis delves into the more subtle aspects that might not be readily quantifiable. By considering factors such as political stability, socio-cultural trends, and environmental regulations, firms gain a better understanding of the broader context in which they operate. This holistic perspective will help you build a solid base for your strategy, and take intelligent decisions that align to your long-term goals.

PESTEL Analysis and Training

PESTEL Analysis is a useful instrument that is used by businesses in a variety of sectors. For example, when it comes to mergers and acquisitions, PESTEL Analysis plays a crucial function in assessing the risk and opportunities associated with potential transactions. Investors can make better investment decisions by evaluating external factors that impact the target company as well as the general market.

PESTEL Analysis also plays an essential role in forming business plans and strategies. By identifying emerging trends and anticipating developments to come, companies can adapt their strategies to capitalize on opportunities and minimize risks. PESTEL Analysis is a valuable instrument for identifying trends that are emerging and for anticipating future developments. It allows companies to modify their strategies to capitalize on opportunities and mitigate risk.

Integration of PESTEL in Financial Models

While financial analysis is still essential in assessing a company’s fiscal performance and health but it’s not complete without the qualitative insights provided through PESTEL Analysis. Through the incorporation of PESTEL elements into financial models, analysts can develop more accurate forecasts and projections that consider external factors. This enables companies to make more informed financial decisions that are grounded in a complete knowledge of both internal as well as external factors. Click here Understanding PESTEL Analysis

Conclusion: Leveraging PESTEL analysis for strategic advantage

In conclusion, PESTEL Analysis stands as an efficient tool for understanding and navigating the complexities of the business environment outside. Business leaders can make decisions by having a greater understanding of the operational environment by constantly assessing technological, economic as well as legal, social and environmental aspects. PESTEL Analysis helps organizations adapt to a changing world by identifying opportunities and minimizing risk. PESTEL Analysis, which is utilized to assist in strategic planning and decision-making, remains an essential instrument for companies in the face of new challenges and opportunities.